#GoldenEagleFamily

The New Student and Family Engagement (NSFE) office at Cal State LA looks to be a leader when it comes to connecting our students with dependents to the institution. The NSFE office understands that these students face many challenges when completing an education. Students with dependents need support so that they may accomplish their goal, a degree from California State University, Los Angeles!

The Family Engagement team, within the NSFE office, is here to help! Assisting with locating services, campus resources, providing valuable information, including many more opportunities.

Early Registration

California Education Code Section 66025.81 requires CSU campuses to grant enrollment priority for student parents. It further clarifies that a “student parent” means a student who has a child or children under 18 years of age who will receive more than half of their support from that student.

Support Resources

Explore financial, nutritional, and child care programs and resources available for you.

Thank you for attending! #GoldenEagleFamily

Thank you for attending! #GoldenEagleFamily

Thank you for attending! #GoldenEagleFamily

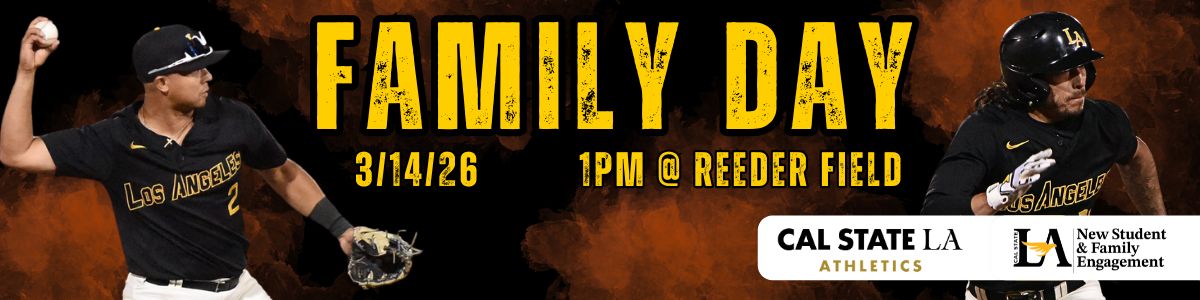

Register for tickets before March 9th! #Take Flight

Event Website: [CLICK HERE]

Coming Spring '26 finals week!

More details will be released at a later time!

Students with Dependents Handbook

From food assistance resources to our campus map identifying where the lactation rooms are, the SWD Handbook shares a collection of valuable information.

Are You Expecting A Child?

In order to have additional services, students who are expecting a child should complete the following!

Student Rights & Benefits

Title IX of the Education Amendments of 1972 (“Title IX”), 20 U.S.C. §1681 et seq., is a Federal civil rights law that prohibits discrimination on the basis of sex—including pregnancy and parental status—in educational programs and activities. California law equally prohibits discrimination based on pregnancy and parental status. This means that students who are pregnant and parenting must be given equal access to educational programs and activities.

How is this achieved?

- Early registration – Early registration appointments are now available for students with dependent children under the age of eighteen. For more details, visit Registration & Enrollment.

- Class attendance – Students may not be prevented from attending classes on the basis of pregnancy.

- Excused absences – Student absences due to childbirth or illness related to pregnancy must be excused so long as it is justified by medical documentation.

- Make up work – Professors must allow students to make up work if deadlines were missed due to childbirth or illness related to pregnancy (so long as it is justified by medical documentation).

- Lactation rooms – Parenting students must be given access to lactation rooms on campus for pumping or breastfeeding.

- Lactation Program (PDF) – Policies and practices for lactation support and accommodations

- All Gender Restrooms, Lactation Rooms and Baby Changing Stations (PDF) – Campus map of all gender restrooms and lactation rooms

- Accommodations – Pregnant students are allowed to request case specific reasonable accommodations so that they may participate in classes or school related activities provided that the accommodation does not fundamentally alter the nature of the course.

If you're experiencing any challenges in accessing your rights as a student parent, please follow the steps below:

- Contact the Title IX Office at 323-343-3040 or [email protected] so that we can discuss what we can do to support you during this time. The Title IX Office is located on the sixth floor of the Student Services Building, Suite 6381.

- Keep notes about your pregnancy-related absences, any instances of possible harassment or discrimination based on pregnancy or parenting status and your interactions with faculty or employees about your pregnancy

- Make copies or retain all medical documentation regarding your pregnancy in the event that you would need to submit them to professors, Title IX Office, etc.

- Schedule meetings with your academic advisor, financial aid office, registrar’s office to discuss any repercussions that can result from taking a semester off or withdrawing/dropping any classes.

Plan Your Visit!

Inside the Gender and Sexuality Resource Center, the Lactation Room for parenting students is stocked with resources such as diapers, toys, children's books, and blankets. Stop by and speak with the GSRC Coordinator!

Located on the 2nd floor of the University-Student Union

Have additional questions? Contact the Assistant Director of Family Engagement via email [email protected]