Cal State LA Annual Budget

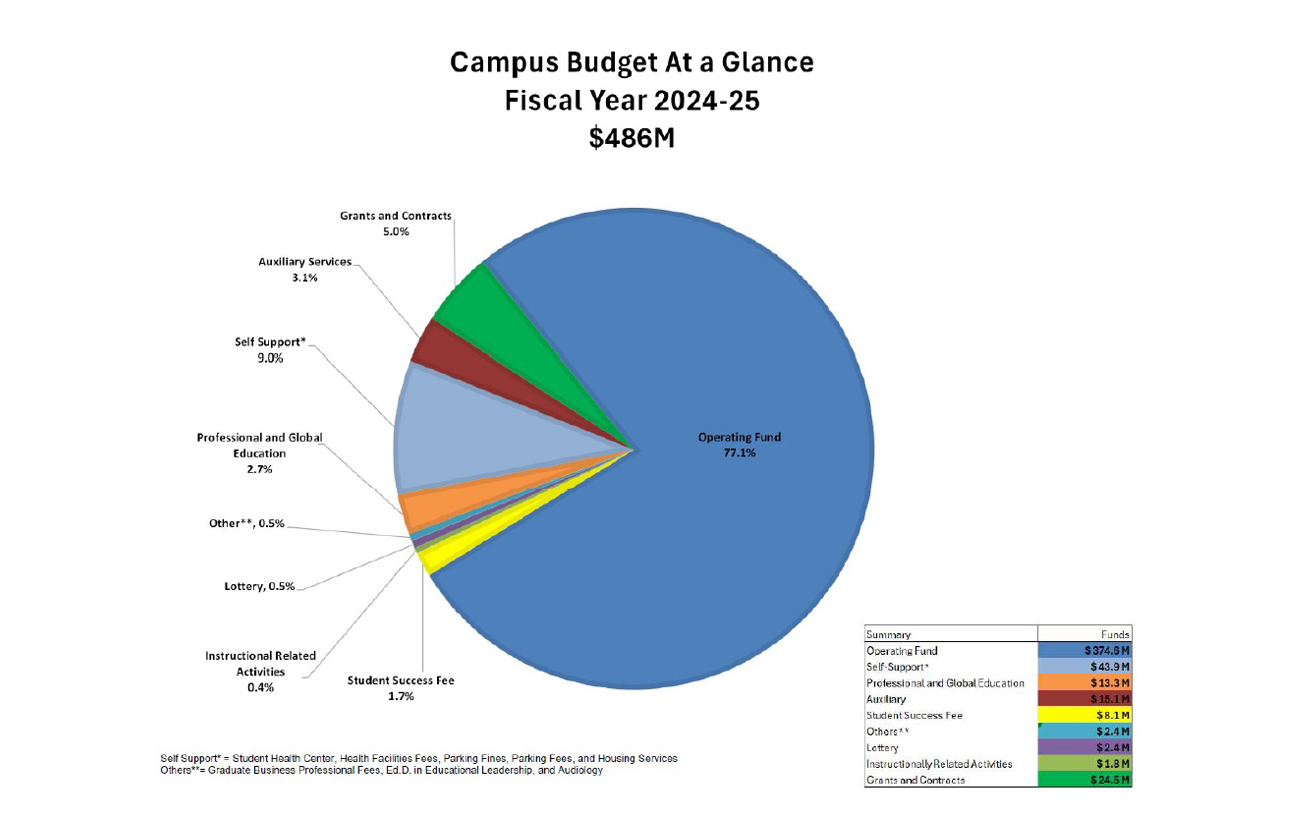

At Cal State LA, managing a university of our size requires funding for a wide range of activities, which are tracked through multiple funds that make up our campus budget. These funds are structured to comply with state laws, education codes, and regulations set by the CSU Board of Trustees, which require specific activities to be accounted for separately. For example, state-funded activities are distinct from self-supporting operations such as housing, parking operations, and auxiliary organizations. At the core of our financial operations is the general operating fund, which supports the majority of campus activities and is primarily funded by state allocations and student tuition.

| Revenue Sources | Amount |

|---|---|

| Operating Fund | $374,628,722 |

| Self Support | $43,948,042 |

| Grants and Contracts | $24,500,000 |

| Auxiliary Services | $15,142,330 |

| Professional and Global Education | $13,265,763 |

| Student Success Fee | $8,073,807 |

| Lottery | $2,446,832 |

| Other | $2,403,111 |

| Instructional Related Activities | $1,802,461 |

| Grand Total | ($486,211,068) |

Notes:

- Self-support: Student Health Center, Health Facilities Fees, Parking Fines, Parking Fees, and Housing Services

- Others: Graduate Business Professional Fees, Ed.D in Education Leadership, and Audiology

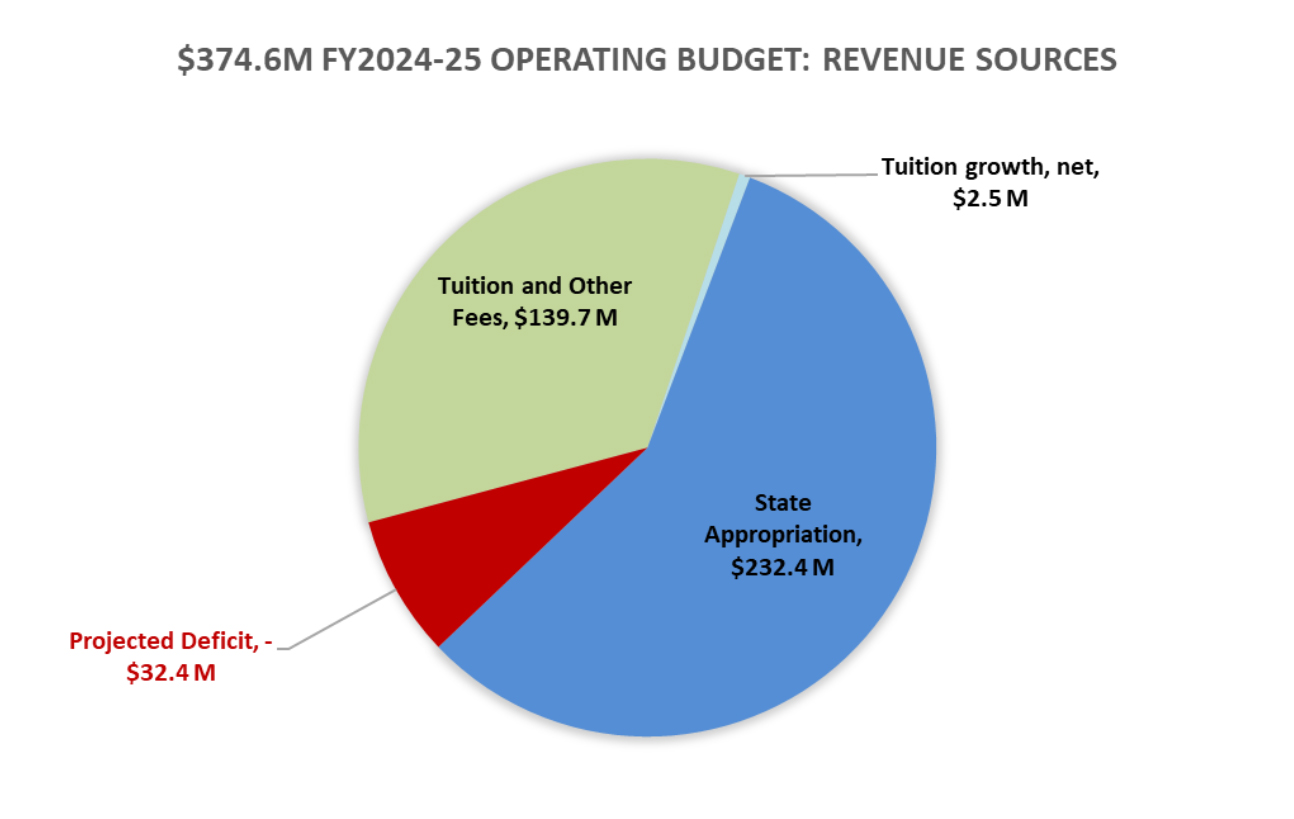

Operating Budget

The Operating Fund is the core of our activity, and is most heavily impacted by changes in state funding, enrollment, and tuition.

The following chart shows our operating budget and how it is divided into the following categories: Tuition and Other Fees, Tuition Growth, State Appropriation, and Projected Deficit.

| Revenue Sources | Amount |

|---|---|

| Total Operating Budget | $374.6 M |

| State Appropriation | $232.4 M |

| Tuition and Other Fees | $139.7 M |

| Tuition Growth, net | $2.5 M |

| Projected Deficit | ($32.4 M) |

Changes to Revenues and Expenses

The tables below present the new revenue sources and expense obligations for the 2024-25 fiscal year. Since the projected expenses exceed incoming revenue, the university anticipates a structural deficit of $32.4 million.

| Revenues | Amount |

|---|---|

| 5% State Appropriation increase (compact) | $16,967,000 |

| Tuition from 6% increase | $8,539,000 |

| CSU Enrollment Reallocation plan (20 FTES, net) | $227,000 |

| Tuition from reallocation plan (20 FTES, net) | $196,000 |

| State Budget one-time reduction | ($3,932,500) |

| Tuition shortfall, 4% below target with adjustments | ($5,381,000) |

| Total | $16,616,000 |

| Expenses | Amount |

|---|---|

| Compensation increase | $25,125,000 |

| Unfunded campus costs | $9,045,000 |

| State University Grant (SUG) financial aid | $6,721,000 |

| Health/insurance premiums & mandatory commitments | $6,398,000 |

| Graduation Initiative / Student Success, Title IX, and NAGPRA | $1,687,000 |

| Total | $48,976,000 |

| Projected Budget Deficit | ($32,360,000.00) |

Addressing the Defecit

Cal State LA's beginning operating budget consists of divisional budgets ($187.1 M), benefits ($98.4 M), as well as restricted budgets for specific areas such as Student Financial Aid ($51.1 M) and university-wide costs ($21.7 M) for essential costs like utilities and insurance. To mitigate the shortfall, a 12.4% reduction in divisional budgets and benefits has been proportionally allocated across divisions, as outlined below.

| Division | 23-24 Initial Base Budget | Proportion % | Budget Reduction |

|---|---|---|---|

| President | $2,451,861 | 1.3% | ($302,886) |

| Academic Affairs | $126,747,279 | 67.7% | ($15,657,464) |

| Student Affairs and Enrollment Management | $17,766,331 | 9.5% | ($2,194,727) |

| Administration & Finance | $35,921,188 | 19.2% | ($4,437,450) |

| University Advancement | $4,222,787 | 2.3% | ($521,653) |

| Division Total | $187,109,446 | 100% | ($23,114,180) |

| Benefits - University Wide | $98,444,486 | ($9,245,829) | |

| Division w/ Benefits Total | $285,553,932 | ($32,360,000) |

Notes:

- Reflects shift of Enrollment Management department from Academic Affairs to Student Affairs and Enrollment Management division.

- Budget reductions reflect 12.4% of 23-24 Divisional Budgets and related benefits at 40% rate.