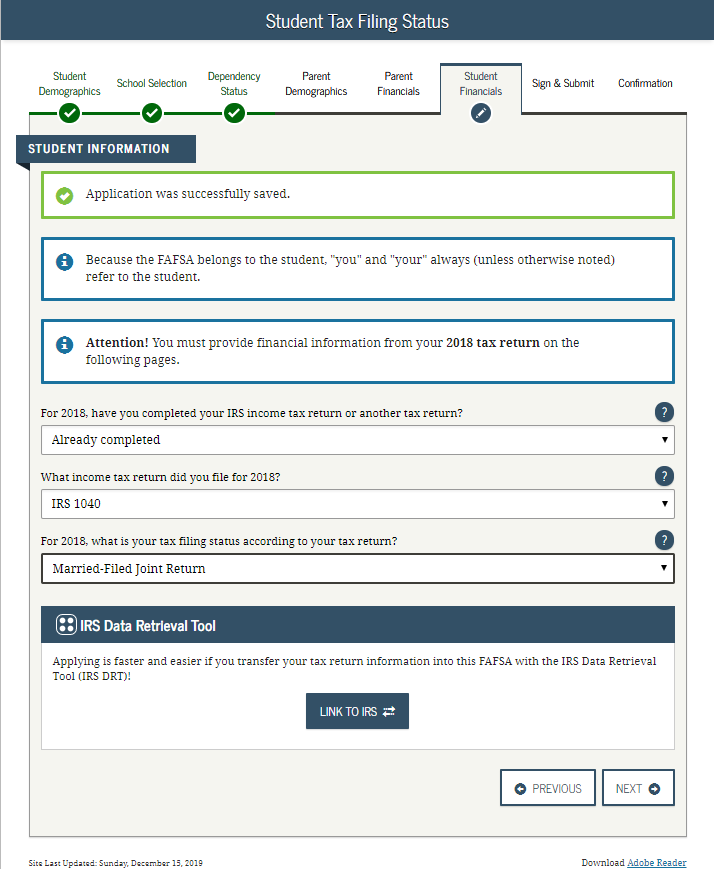

The IRS Data Retrieval Tool is available for online FAFSA submittals and is accessible through the FAFSA . The retrieval tool allows FAFSA applicants and parents with the ability to transfer their income information from the IRS to the FAFSA. See below.

All FAFSA on the Web (FOTW) applicants and parents of dependent applicants who indicate they have filed or will file a federal tax return will be directed to use the IRS Data Retrieval Tool to report and/or update their income information on the FAFSA.

BENEFITS OF USING THE IRS DATA RETRIEVAL TOOL:

- Applicants can complete their FAFSA more easily and accurately!

- The tool will increase the accuracy in the awarding for student financial aid funds!

- Applicants selected for verification can use the tool to update their income information and avoid unnecessary processing delays!

- More information about DRT available directly in FSA Website.

WHEN WILL DATA BE AVAILABLE FROM THE IRS?

Electronic Tax Filers - Data will be available within 24 to 48 hours of filing

Paper Tax Filers - Data will be available within 6 – 8 weeks of filing

If you plan to submit your FAFSA before you and/or your parents complete and submit your Federal Tax Return, then be sure to use the IRS Data Retrieval Tool to update your FAFSA record once the returns have been submitted and the income data is available to be retrieved.

IMPORTANT DATES TO REMEMBER:

- October 1 – students may begin to submit their FAFSA applications

- March 2 – priority funding consideration deadline

WHO IS “NOT” ELIGIBLE TO USE THE TOOL?

- Married couples who file separate tax returns.

- Applicants whose marital status has changed as of January 1st

- Applicants who are neither eligible nor required to file a Federal Tax Return.

SPECIAL ITEM OF NOTE – Applicants who choose not to use the tool OR change the IRS income information

- Applicants who choose not to use the FAFSA-IRS Data Retrieval Tool (OR) applicants who use the tool but subsequently change the income information will be informed they must explain to their institutions why information they provided is more accurate than the information available through the IRS.

- Contact the Financial Aid Office to discuss your circumstances. The Financial Aid administrator may ask you to submit copies of your W-2 form, last paycheck stub, a letter from your employer, tax transcript, or other.

WHAT IF YOUR FILE IS SELECTED FOR VERIFICATION?

If your FAFSA record is selected for a process called verification and you and your parents were eligible to file a federal tax return, you will be required to:

- Use the IRS Data Retrieval Tool to update your and/or your parent or spouse income information; (OR)

- You and/or your parents or spouse may request a “Tax Transcript” from the IRS to submit to the Financial Aid Office to verify your income information.

Select this link for a to request a copy your tax transcript. https://www.irs.gov/individuals/get-transcript